main street small business tax credit ii

On November 1 2021 the California Department of Tax and Fee Administration will begin accepting applications for tentative small business hiring credit reservation amounts through our online reservation system. Qualified employers must apply with the CDTFA for a credit reservation.

Need Your Taxes Done I Have Good Rates And Educate My Clients I Can Process Taxes For Any State Credit Repair Credit Repair Letters Reduce Debt

We will be accepting online applications to reserve tax credits from November 1 - 30 2021.

. Your Main Street Small Business Tax Credit will be available on April 1 2021. You have fewer than 25 full-time equivalent FTE employees. This will be offered via a tax credit against CA income tax or CA Sales and use Tax.

Your average employee salary is about 56000 per year or less. Full WOTC credit in first year of employment requires 400 hours of work. Beginning on November 1 2021 and ending November 30 2021 the California Department of Tax and Fee Administration will be accepting applications through their online reservation system for.

The credit can offset either sales and use tax or income and franchise tax. The Main Street Small Business Tax Credit II will provide COVID-19 financial relief to qualified small business employers. Ad Talk to a 1-800Accountant Small Business Tax expert.

California has passed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. The application period may close earlier if the credits run out. Governor Gavin Newsom recently signed Assembly Bill AB 150 which establishes the Main Street Small Business Tax Credit II.

The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. Maximum second year tax credit is 5000 per new hire. A Pennsylvania resident taxpayer who has non-Pennsylvania sourced income subject to both Pennsylvania personal income tax PA PIT and the income or wage tax of another state according to Pennsylvania sourcing rules on the same income during the same taxable year can claim a credit for the tax paid to the.

This bill provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021 that have resulted in unprecedented job losses. The Main Street Small Business Tax Credit II provides Covid-19 financial relief to qualified small businesses. The Main Street Small Business Tax Credit II may be used to offset income tax or sales tax by making an irrevocable election.

The 2021 Main Street Small Business Tax Credit II will provide COVID19 financial relief to qualified small business employers. To qualify for the tax credit all of the following must apply. Resident Credit Resident Credit for Tax Paid to Another State.

Business property must first be reduced by any Section 179 deduction taken for the property. Maximum two year combined tax credit is 9000 per new hire. The credit in second year of employment requires no minimum number of hours worked.

The Main Street Small Business Tax Credit II may be used to offset income tax or sales tax by making an irrevocable election. Main Street Small Business Tax Credit II. This will provide financial relief to qualified small businesses for the economic disruptions in 2020 and 2021 that have resulted in unprecedented job losses.

The 2021 Main Street Small Business Tax Credit II reservation process is now closed. Available credits are limited so dont delay. 10000 Monthly Deposits Into Business Bank Account.

A tax credit of up to 1000 will be credited for residential installations and up to 30000 for business or investment use property. You offer SHOP coverage to all of your full-time employees. Maximum first year tax credit is 4000 per new hire.

You pay at least 50 of your full-time employees premium costs. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. Welcome to the California Department of Tax and Fee Administrations 2021 Main Street Small Business Tax Credit II.

Main Street Small Business Tax Credit II. A tentative credit reservation must be made with the CDTFA during the period of November 1 2021 through November 30 2021 or when the funds are depleted whichever comes first. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II.

Ad Talk to a 1-800Accountant Small Business Tax expert. You will be able to apply your credits against your sales and use tax liabilities for reporting periods starting with returns originally due on April 30 2021 and subsequent returns until they are exhausted or until April 30 2026 whichever comes first. The new tax credit program provides financial relief to qualified small businesses for economic disruptions in 2020 and 2021 resulting in job losses.

On November 1 2021 California will begin accepting applications for tentative small businesses through its online reservation system. The total amount of credit available is approximately 116 million and will be allocated on a first-come first-served basis. You can apply for a reservation at 2021 Main Street Small Business Tax Credit II.

On November 1 2021 the California Department of Tax and Fee Administration will begin accepting applications for tentative small business hiring credit reservation amounts through our online reservation system.

New Markets Tax Credit Investments In Our Nation S Communities

Give Us A Call 612 440 8651 Send Us A Message Info Abdulghaffar Com Opening Hours Mon Friday 8am 5p Bookkeeping Services Accounting Services Bookkeeping

Five Easy Steps For Enrolling In The Small Business Health Options Program Health Options How To Plan Health

Tax Services Tax Services Income Tax Return Accounting Services

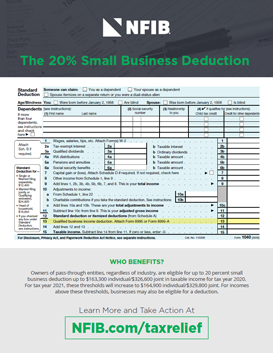

Tax Reform For Small Businesses Nfib

Five Truths About How The Inflation Reduction Act Will Help Small Business And Working Families

Invoice Template Editable Invoice Template Excel Automatic Etsy Invoice Template Bookkeeping Templates Small Business Bookkeeping

Credit Card Statement Template Excel Unique Small S Accounts Spreadsheet Plan Income Excel Spreadsheets Templates Business Budget Template Spreadsheet Template

Tax Reform For Small Businesses Nfib

Tax Reform For Small Businesses Nfib

Having Health Insurance Is Important Having Health Insurance Is Important To Your Health And Financial Security If You Health Matters How To Plan Tax Credits

Job Hiring Flyers Flyer We Re Hiring Jobs Hiring

Neon Unicorn Holographic Thick Glitter Drip Credit Business Card Zazzle Glitter Business Cards Business Cards Beauty Business Cards Elegant

Tax Services Tax Services Income Tax Return Accounting Services

Hiring Flyer In 2022 Graphic Designer Office We Are Hiring Sales Manager

5 Steps For Effortless Bookkeeping Bookkeeping Accounting Accounting Services

J K Lasser S Small Business Taxes 2022 Your Complete Guide To A Better Bottom Line Wiley

Vintage Radios Historical News Poster Antique Poster Etsy Vintage Radio Radio Historical News